WPA enhances Complete Health with underwriting and NCD upgrades

WPA, one of our top rated health insurers for 2026, has announced a series of improvements to its Complete Health product, designed to simplify the application process and provide fairer rewards to low-claiming customers.

From simpler underwriting rules to a more generous no claims discount (NCD) structure, the changes will roll out in stages between August and November 2025 and are set to benefit customers applying or switching to Complete Health.

Fewer disclosure requirements

WPA has removed a set of declaration questions from its online application process. Anyone applying will no longer be required to disclose whether they have had insurance declined, have a criminal conviction, or have a County Court Judgment (CCJ) or Individual Voluntary Arrangements (IVA).

These changes will apply to all types of underwriting. However, the insurer emphasised that paper and PDF-based application forms will continue to include the questions for the time being, until revised versions are released.

Simplified switch underwriting

Further changes are set to take effect from 1 September 2025 for individuals switching to Complete Health from another provider. Under the updated switch process, WPA has added some new medical underwriting questions that will focus on four clear areas:

- Whether anyone applying for cover has had any disease/abnormality of the heart or cardiac function, stroke, or cancer in the last five years.

- Any recent treatment for back, spinal, knee, hip or shoulder issues within the last two years.

- Any planned or pending treatment, either on the NHS or private.

- Any mental health treatment, including anxiety, stress and depression, within the past three years.

The insurer confirmed that these changes will initially apply to online applications only, with updated paper forms to follow. WPA underwriters are developing guidance to clarify disclosure expectations for applicants, which is expected to be published shortly.

A more generous NCD structure

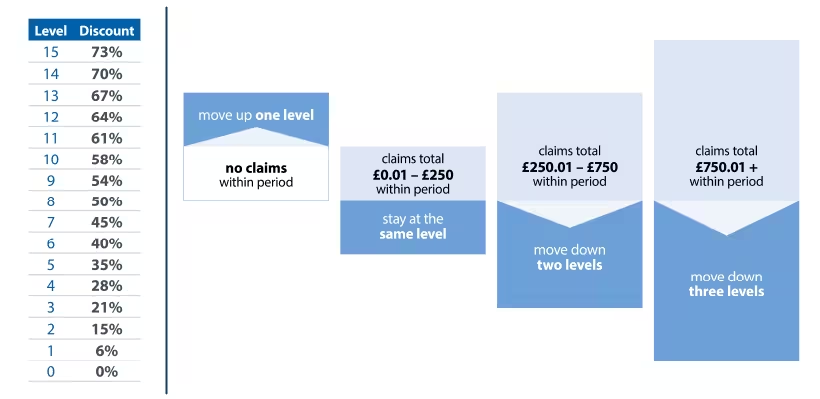

WPA also revealed that it will be making some key changes to its no claims discount system from 1 November 2025. Under its new rules, small claims of up to £250 will no longer affect a customer’s discount level, a change aimed at removing the penalty for minor healthcare expenses. Previously, a customer making a small claim would have moved down WPA’s NCD ladder by one step.

At the same time, WPA will add a 15th tier to its NCD ladder, allowing loyal customers to receive up to 73% off their health insurance premiums, up from the previous maximum discount of 70%.

Further reading: WPA Health insurance review (2026)

See how WPA Complete Health compares with other providers in our impartial guide: