In this guide, we explain what you need to know about small business health insurance in the UK and provide you with some practical tips on how to get the best deal.

Small business health insurance gives your employees access to high-quality private medical treatment without the NHS waiting lists. Health insurance policies vary depending on your chosen provider. However, most provide core coverage and offer various optional extras so you can tailor your health insurance to suit your needs.

Small business health insurance offers group coverage, covering all your staff as long as you keep paying the monthly or annual premiums. Most policies cover small businesses with as few as one or two employees and up to 249 employees.

Private medical insurance policies offer many business benefits. It's a valued employee benefit and shows that you prioritise employee wellbeing, which can help you attract new employees and retain existing ones. Sometimes, small business health insurance can help prevent absenteeism by giving employees access to preventive care. Alternatively, it can shorten their absence from work by providing quick access to treatment.

Small business health insurance provides access to private treatment that quickly helps your employees recover from illness or injury. It can also give your team access to cutting-edge treatments and medications not currently available via the NHS.

Private medical insurance also offers other employee benefits that let them schedule appointments around their other commitments, improve their general health and wellbeing and save money. These can include 24/7 virtual GP appointments, health screening and membership rewards and discounts.

Your small business health insurance cover will vary depending on your chosen provider. Most insurers offer some treatments as part of their basic health insurance policy and offer various optional extras so you can tailor your policy to your circumstances.

Here are some options you can expect to find with most business health insurance policies.

Here are the treatments and services you'll find on most business health insurance policies.

In-patient and day-patient treatment involve spending time in a hospital bed. In-patient treatment involves an overnight stay, while a day-patient unit allows patients to go home to sleep. Treatment may involve surgery or cancer treatment, such as chemotherapy, which requires monitoring over several hours.

In-patient cover pays for your employees' accommodation costs in a private room and all their treatment expenses, including consultant's fees, anaesthetist, nursing care, and medication.

Cancer affects 50% of us at some point in our lives, and it forms a core part of every health insurance policy. Policies vary in what they provide as standard. Most small business health insurance covers surgery, chemotherapy, and radiotherapy. Some offer advanced therapies such as stem cell transplants and support services, including advice on prosthetics and nutrition.

Some health insurance providers include basic cancer cover and offer the option to enhance it if needed.

Most small business health insurance provides basic mental health cover through counselling sessions and self-help resources. Your private medical insurance may include up to eight counselling or cognitive behavioural therapy (CBT) treatment sessions for employees without needing a GP referral. Health helplines can signpost employees to mental health resources or offer general advice.

Many insurers also provide access to self-help resources, such as online articles or self-assessment tools, to help employees manage their mental wellbeing and seek mental health support if needed. Some health insurance reward schemes also offer discounted access to mental health apps.

Historically, out-patient coverage was only available as an optional extra. However, most health insurance now includes some limited out-patient coverage as standard. This varies between providers. Some cover an out-patient diagnosis, including a fixed sum towards an initial consultant appointment. Others include out-patient procedures such as cataract surgery. Your employees may also be able to access between eight and ten physiotherapy sessions without a referral.

Optional extras let you tailor your small business health insurance policy to suit your business needs and workforce. Some health insurance providers offer completely flexible policies so you can build your own plan. Others offer the same core coverage to all their customers and a range of optional extras that you can add if needed.

Different insurers vary, but here are some of the most common optional health insurance extras.

Adding out-patient treatment to your small business health insurance policy will enhance your coverage beyond the basic policy. You can often choose a financial limit to control your overall spending or add different types of out-patient cover.

Full out-patient cover gives your employees access to private diagnostic tests and consultant appointments to provide a quick diagnosis and an onward referral to surgery or further out-patient treatment as required.

It's worth checking whether out-patient cover also includes therapies coverage or whether your chosen insurer only offers this separately. Some insurers now allow you to add therapies such as physiotherapy, osteopathy, and acupuncture as separate additional cover.

As mentioned, all small business health insurance includes some mental health cover. However, if work-related stress is a concern for your employees, it is worth paying more to provide additional support and treatment for mental health issues.

Mental health cover can provide more counselling, CBT sessions, and a broader range of treatments. Most mental health insurance will also pay for in-patient psychiatric treatment if needed.

Optical and dental cover often come as a package, although some providers offer standalone dental cover. Adding optical and dental cover to your business health insurance can be a cost-effective way to pay for eye tests and glasses for employees who work with display screens.

It can also be a valuable part of your employee benefits package if your employees already pay for their optical and dental care, as it can lower their private healthcare costs.

Business health insurance includes a standard hospital list setting out which private hospitals and treatment centres the policy covers. These can also include private units in NHS hospitals. Extended lists cover hospitals with higher healthcare costs, such as those in central London or other major cities.

Adding an extended list for an additional premium can enable your staff to have treatment close to their home or work if your business is based in a high-cost area.

Employee assistance programmes (EAPs) provide 24/7 telephone or online advice and support. Many EAPs focus on mental health support. They're ideal for small businesses where employees may be reluctant to speak to a supervisor about a personal issue because they fear it may damage their career. EAPs provide confidential third-party support.

While many EAPs prioritise mental health, they can also offer help with legal issues or financial worries.

Business health insurance provides access to other services and employee benefits regardless of your chosen policy coverage. These typically include virtual GP appointments and a health information phone line for support with routine medical issues. Some policies also provide health assessments and support to keep employees healthy and help your business devise wellbeing initiatives.

Most insurers now have a rewards programme providing perks and discounts on gym memberships, smoking cessation programmes and holidays. Some offer discounts as rewards for healthy living to motivate your team.

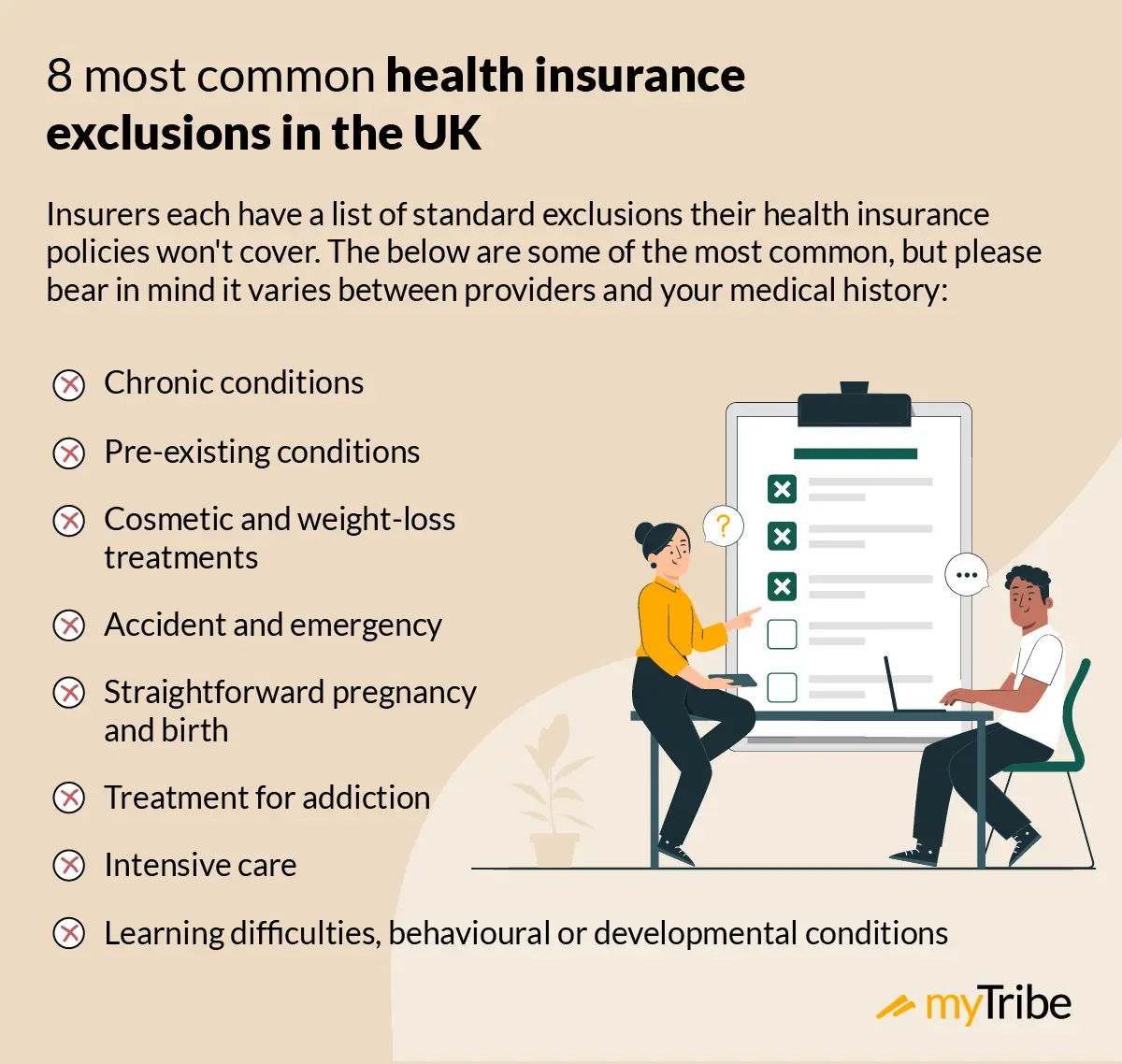

Every health insurance plan has exclusions. Some are specific to your insurance provider and apply to all their customers, while others depend on an employee's medical history.

Pre-existing conditions are any medical conditions that an employee sought advice or treatment for in the five years before joining the policy. For example, your employee may have had physiotherapy to relieve a frozen shoulder before joining the policy. A few months after joining, the condition worsens, and their doctor recommends an arthroscopy. Your private medical insurance wouldn't cover the surgery; it will only cover injuries or illnesses that arise after coverage begins.

If an employee stays symptom-free for the first two years of coverage, your insurers can remove the exclusion.

Chronic conditions are illnesses with no known cure and that require long-term monitoring and ongoing care. Private medical insurance only covers acute conditions that can be cured, such as musculoskeletal issues, cancer, and heart conditions that respond to surgery. It won't cover angina, diabetes, or high blood pressure.

Standard policy exclusions apply to all the health insurance an insurer offers regardless of an employee's medical history. Some insurers have exclusions that others don't, while some provide coverage for treatments typically excluded elsewhere. If you know about a common health issue affecting your industry or employees and want to ensure your small business health insurance covers it, always check the small print.

The cost of health insurance for small businesses varies depending on various factors and your chosen provider. Your insurer bases your monthly premium on the risk you and your employees will claim on the policy. Every insurer assesses risk differently, so it's worth shopping around.

They'll look at factors including the nature of your business and the policy you choose.

Business health insurance is an allowable business expense for corporation tax purposes, so you could save money on your tax bill.

Comprehensive private medical insurance costs more than a basic policy. Adding optional extras to your healthcare cover will increase the cost but can also offer more significant benefits, including a quicker diagnosis and more support services. Speaking to a broker can help you decide where to spend your money to get the best value.

Your premiums may also be higher if you allow employees to add their family members to the policy.

Your chosen policy underwriting can significantly impact premiums, particularly where an employee's medical history doesn't affect exclusions.

We've mentioned that insurers exclude pre-existing conditions from cover for the first two years after an employee joins the policy. When you choose moratorium underwriting, your insurers won't ask employees to provide information about their medical history when they join but will check for exclusions when they claim. This can mean more claims are rejected and often makes the process longer.

Full medical underwriting applies a two-year moratorium period in the same way as moratorium underwriting. However, with full medical underwriting, your insurer will ask employees to provide medical history details when they join. This gives your employees and insurers more certainty about what's covered, meaning it's often a bit cheaper than moratorium underwriting. The claims process is typically quicker, with fewer rejected claims.

Medical history disregarded underwriting is ideal if you want to ensure your employees can access private healthcare without worrying about individual exclusions. NHS waiting lists mean your employees may face long waits for NHS treatment if they can't access private healthcare, which can negatively impact your business if you have a small team. Medical history disregarded underwriting also allows your employees to keep their pre-existing conditions private as they won't have to explain why they're facing a longer wait for treatment.

Medical history disregarded underwriting is the most expensive type and is usually only available to businesses with at least 20 employees.

If you already have private medical insurance for your small business but want to switch to a new provider, CPME or CMORI can be more expensive and complex than other underwriting types but helps you keep the terms and conditions you've earned with your previous insurer. CPME allows you to transfer your policy without adding new exclusions due to treatment already received under the policy.

CMORI lets employees transfer the moratorium period they've already earned with the existing health insurer without starting from scratch.

Here are some of the business-related factors your insurer will consider when issuing a quote:

There are ways to lower the cost of your health insurance to suit your budget or allow you to spend more on increased coverage elsewhere.

Adding a policy excess means that employees pay for part of their treatment. You can choose an annual excess where they only pay once yearly or add an excess to each new claim. Insurers offer excesses at various levels so you can adjust the excess to meet business needs. However, it's essential to consider what your employees will be willing and able to pay. A high excess may cause them to wait for NHS care rather than claiming on the policy, meaning you lose the benefits health insurance provides.

A six-week wait option means your insurance won't cover private healthcare if your employee can access NHS treatment within six weeks. NHS waiting lists are currently at a level where this won't be a problem with elective treatments. However, if an employee goes to A&E after an accident, they're classed as having received treatment within six weeks, meaning their health insurance won't cover any follow-up rehabilitation or surgery.

Choosing an extended hospital list costs more but gives employees more choices about where to receive treatment. However, opting for a guided consultant choice can reduce costs by providing more limited options.

When an employee claims, they'll receive a list of 3-5 consultants in their local area and can choose the one they prefer. It can be less overwhelming than a free choice of consultant and hospital. Guided consultant choice works by selecting doctors with lower fees to reduce the total treatment cost. Some higher-cost consultants also enter into agreements to accept a small number of patients at a reduced rate, particularly if the treatment they provide is highly specialised.

Here's our round-up of the small business private health insurance policies from some of the UK's leading providers.

Aviva's private health insurance for small businesses covers 1-249 employees, so you can use it as a one-person limited company. The core cover with their Solutions policy includes in-patient and day-patient treatment, comprehensive cancer cover, and direct access to counselling. Their BacktoBetter service provides treatment for musculoskeletal issues without a GP referral. They also cover out-patient tests, treatments, and access to physiotherapy and other physical therapies if their consultant recommends them. You can add GP referrals for an additional premium if you choose to.

You can add dental and optical coverage, upgraded mental health care, and an extended hospital list to your policy.

AXA health insurance provides flexible coverage, so you can tailor your plan to meet your needs. If you want to cover only one or two employees, you must choose between the treatment option and the diagnostics-only option. Every customer can access virtual GP consultations and discounted gym memberships.

The treatment option includes in-patient and day-patient cover, out-patient surgery, cancer cover, complex scans and an NHS cash benefit. The diagnostics-only option includes two consultant appointments per year, diagnostic tests and out-patient surgeries.

Otherwise, you can choose out-patient cover, therapies cover, mental health treatment, dental and optical cashback plan or travel insurance as a single option.

Bupa offers four levels of cover that let you choose the level that suits your needs and budget and receive a package of coverage including:

Your employees can also access virtual GP appointments and telephone support lines. Optional extras include wellbeing support, women's healthcare, employee health assessments, dental cover and an employee assistance programme. Bupa also offers workplace counselling, mental health training, and workplace vaccinations.

Vitality puts health and wellbeing at the heart of its private health insurance. Its rewards programme offers perks and discounts to employees who achieve their health goals. The company's core coverage includes in-patient, mental health, and cancer treatment, out-patient surgeries, and up to six physiotherapy sessions.

Optional extras include enhanced mental health and out-patient cover with various financial limits, an employee assistance programme, therapies cover, optical, dental and hearing cover and travel insurance.

WPA provides flexible coverage depending on the size of your workforce. Small business health insurance is available for 2-150 employees. Enterprise Flexible Benefits covers 2-14 employees and provides all the core coverage you'd expect, including out-patient tests and procedures. You can also add therapy cover, additional counselling, dental care, emergency treatment abroad and a cash plan.

Precision Corporate Healthcare covers 10+ employees and lets you choose health insurance, a cash plan or a combination of both. Depending on whether you choose health insurance or a cash plan, you can tailor your cover with different optional extras. There are business-focused extras, including an employee assistance programme, and they'll also provide data insights to show you how your plan is performing.

Finally, their NHS top-up is available for 3-49 employees. It's a low-cost option that pays your employees cashback on their routine healthcare expenses, including prescriptions, dental treatment fees and eye care. Depending on your chosen cover, the plan can also help employees get quick access to physiotherapy, chiropractic treatment and advanced cancer drugs.

At MyTribe, we aim to help you learn more about health insurance so you can understand your options. Speaking with a broker will give you tailored advice on the best small business health insurance for your needs. Contact us today for a comparison quote, and we'll put you in touch with a high-quality, regulated broker.

Disclaimer: This information is general and what is best for you will depend on your personal circumstances. Please speak with a financial adviser or do your own research before making a decision.

The cost of health insurance for small businesses can vary significantly depending on factors, such as the number, age and location of your employees.

A basic policy with a high excess could cost as little as £25 per employee per month; a mid-range policy would be around £60, with comprehensive costing up to above £85 per employee per month.

Yes, health insurance paid for by a company is a business expense. It is, therefore, eligible for Corporation Tax Relief; however, the company will have to pay Employers National Insurance contributions.

Business health insurance is classed as a P11d Benefit in Kind, so the employee will pay personal tax on the value of the benefit they have received.

There are a few ways you can get business health insurance:

You can speak to the insurers yourself and obtain quotations directly

To get a fair comparison, you will need to approach each insurer independently and obtain quotes to make a decision yourself. As the insurers cannot offer independent advice, you will need to consider all of the information they provide and decide which you feel best suits your business.

You can speak to a business health insurance specialist

A business health insurance specialist will know about all of the available products from the leading providers and will be able to source pricing on your behalf and provide independent advice on which policy would suit your business.

You will usually need three employees to set up a group scheme; anything less than that will usually be a similar price to setting individual policies.

How many employees do we need to get a Medical History Disregarded (MHD) policy?

You will need at least 20 employees to access Medical History Disregarded underwriting. As the name suggests, this type of underwriting disregards the members’ medical histories and gives them full cover for both new and pre-existing acute conditions. As you might expect, this is the most expensive type of health insurance underwriting.

Save up to 37%* on your insurance by comparing policies

*Based on 461 quotes between 01/22-01/23